***DISCLAIMER: THIS IS AN UNOFFICIAL UNENDORSED SUMMARY WRITTEN BY A PRIVATE INVESTOR***

Link to full 3 hour webinar video: http://view-w.tv/939-1281-16835/en

Internal Video (Tungsten 100 Day Review): http://gaia.world-television.com/tungsten/video01/index.html

Rick said TUNG came to market with high expectations and too much hype. We traded at an inflated valuation. The resources and operating facts on the ground couldn’t support the aspirations. 25% of the float is with insiders this thinly traded stock fell, value was eroded and TUNG became a ‘fallen angel’. Former leadership failed to provide a candid recalibration of what went wrong.

Rick would like to answer two questions this afternoon:

1. What is the risk adjusted rationale for purchasing shares in TUNG?

2. Why now? Why won’t past performance simply be a future prologue to future results?

This afternoon is a re-introduction to Tungsten: Its products, its new management team and the strategic outcomes that we seek to pursue.

After Rick’s appointment:

Tung business landscape examined and evaluated by senior leadership team.

Where they were:

- Structural deficiencies (constrained contracts, organisational structure that institutionalised structural divides, legacy IT infrastructure that wouldn’t let them scale profitably)

- Little cost discipline

- TEP not scalable

- Lacked cultural coherence

- Accountability was fleeting (no single end-to-end owner for the processes en route to revenue)

- Skill gaps

Where they are:

- Contracts adapted so that they are highly consumable

- Will concentrate on emerging subjects like ‘data rights’ for example.

- Today they operate with a factory like structure – e.g. one owner for supplier onboarding processes with full accountability

- Moving from a monolithic IT infrastructure to a highly flexible modular one

- TEP yields increasing, penetration rates above norms, TEP marketplace is being expanded so scale can be achieved. This will involve taking supplier risk and using TUNG data to mitigate that risk.

- People development is a priority at the firm; incentive & appraisal programmes in place.

- Cost disciplines in place

- Effective and efficient digital processes

- Changed culture – mindset and behaviour of 400 employees changed.

- TUNG’s relationship as a highly trusted advisor provides opportunity for custom element for customers that is thoughtful and targeted

- TUNG will engage with users of the portal more fully than ever – stores, value added content

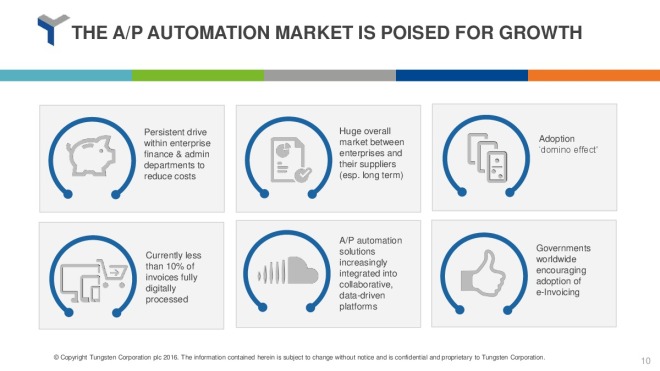

- Strategic objective no 1: the movement to remove paper from payables process growing at 20% annually but its woefully underserved (CFO’s when asked have <10% of their invoice flow digitally) – so we have the wind in our backs and sizeable opportunity in front of us – TUNG to tackle this as objective no 1.

- Strategic plans to decouple costs from growth

- Sizeable six figure contract for TUNG data

- Evolve deeper relationships with buyers

- Enhanced digital engagement with suppliers

- Rebooted financing effort – TEP 2.0 in development and will take invoice finance to scale (expanding product, taking some supplier risk, managing through use of tung data, deploying tech in front of buyer client)

- Expanding through adjacent services such as fx – digitisation of common practices that exist

- Act more agile going forward and use technology to scale profitably

- Tungsten Workflow (Docusphere) – product roadmap includes migration of that service into a cloud environment

- 11 deals to be closed in Q4 (highest ever)

- Siemens and TUNG in a ground-breaking effort to offer e-invoicing in India

- Rick believes he can grow the business 25% compounded annually and if TUNG does that over the next 5 years the business doubles twice.

Rick’s four new hires to drive business forward from a senior level:

- CTO Brian Proffitt

- CMO Connie O’Brien

- Corporate Development: Guy Miller

- Tungsten Network Finance head starting in 8 weeks TBA

- Enhanced independence and governance by reshuffling the board and also appointing non-execs Ian Wheeler and David Benello introducing germane skills.

- Contracts repriced according to the value that the customers derive from TUNG.

- Historical issues such as auto-renewed contracts or contracts with lots of included/free transactions are being changed to a new ‘standard revenue model’ which includes an implementation fee, fixed annual fee and variable transaction fees designed to increase customer commitment in e-invoicing as it becomes cheaper the more they use it but also to give TUNG stability and upside with regards to revenues (faster time to value for the customer and faster time to revenue for TUNG).

- Customers are the ‘global supply chain’ and will be treated as so (there is a continuum of buyers who are also increasingly suppliers on the network and suppliers who are in the pipeline to become buyers)

- Deploying factory automation mindset (capacity planning techniques/social media “connections”/API style integrations/Digital Marketing Command Centre)

- Buyers on the network who are suppliers too are pushing Tung to empower their technology to their customers (Buyers) – they want to see TUNG technology deployed in a way that benefits them as a “supplier”.

- Buyer CFO’s just as interested in TEP as SME’s

- PNC partnership yielded 4 buyers in the last 4 months.

- PNC have a sales force 5x larger than TUNG and they will be driving TUNG products including Tungsten Network into their 6,000 customer base.

- They are looking at OEM’ing Tungsten Network and sales through other partners, BPO’s, consulting firms etc.

- Cross selling Tungsten Network to the Workflow (Docusphere) base and vice versa is yielding results.

- 11 potential Q4 deals with a greater than 50% chance of closing

Interview: Siemens: http://gaia.world-television.com/tungsten/video03/index.html

Brian Proffitt

- Implemented salesforce

- Faster supplier on boarding – Goldsmith helping identify new supplier matches with high 90%s accuracy

- Implementing API’s to automate – make things occur faster and at a lower cost

- Install a SaaS store to sell 3rd party services to customers

- “Shifting left” so customer service is improved and staff can concentrate on other activity and improve scalability.

- Processes to allow supplier onboarding with less effort

- New processes for customers to allow quicker connections to other buyers (49% of all queries)

- Revitalised technology platform – Developing and implementing a new “scalable” technology stack to replace the old one

- Trigger marketing – communicate automatically rather than using people

- Building tools to allow suppliers to self-onboard and therefore reducing the biggest driver of costs in our biggest cost area.

- Mobile applications for customers.

As per his name, this man is going to help make e-invoicing more profitable by introducing efficiencies that will decouple costs so profit per invoice is higher. Everything he talked about on and off the mike was about reducing costs or increasing profit as we scale.

Goldsmiths team are still working with us for another couple of years. I wondered if losing the last CTO (Chris Lowrie) would make it challenging to transfer to new systems but he assures us that it won’t be a problem and if it did, he’s still in touch with him so can liaise if needed.

The official timeline given is 15 months for the new “scalable” technology stack to be ready though unofficially it is thought this will happen earlier. They decided to adopt salesforce in October and salesforce said it couldn’t be installed by December – Brian Proffitt made this happen and it was indeed installed by December 15.

Iain Hunter

- Has been with TUNG for 4 months and will soon be leaving after bank sale. He advised Hurwitz with respect to selling the bank.

- Bank sale is on-track

- £104 million cumulatively financed to Jan 16 (£13 million in December 2015 alone)

- “Current” TEP 1.0 is not scalable, addressable market is constrained (£900m) – size needs to be increased

- Current yields in excess of 6%

- Risk appetite of funding partners does not correctly reflect product nor risk profile taken today

- TEP 2.0 in development

- Initial bigger market size (£12.7bn of total target population of £26.5bn)

- By increasing addressable market by financing invoices without PDD (payment due date)

- Grow rapidly into new jurisdictions

- Ease the requirement for bank account change – suppler is agent

- Open up US$ and Euro financing components

- Eventually move away from changing bank account details

Iain Hunter’s TEP Conclusion:

- New material appointment of head of Tungsten Network Finance

- Execute quick wins/simple adjustments to increase addressable market

- Drive buyer engagement – critical

- Seek smart strategic solutions supported by strategic funding partners

- Expand product offering outside of core business today

- Target bank partnerships – white label proposition

- Leverage digital command centre

Off the mike he explained the lengthy TEP registration process and went into detail about bottlenecks such as:

- After a tungsten nominated bank account has been created it can then take up to 60 days for the actual buyer to change bank details – currently lack of incentive in driving buyers consent to support the product.

- Therefore supplier would have to wait up to 60 days before using TEP

- The agreement with insight was historically restrictive such that if the buyer when approving an invoice fails to put in a “payment date” then Tungsten are not able to offer TEP on those e-invoices – in the presentation this was highlighted such that the TEP 1.0 addressable market is only £900m.

- TUNG for have/are in the process of addressing all the bottlenecks to make it genuinely easier for a supplier to register for TEP and quicker to use TEP.

TEP Customer Interview (Abacus Industrial Flooring): http://gaia.world-television.com/tungsten/video02/index.html

- Create enduring e-invoicing partnerships with strong local technology business which have close links to the suppliers

- Fx

- Offering to lower the cost and increase the penetration of VAT reclaim for Buyers

- Seize opportunity when there is buyer pressure to onboard suppliers in new countries when e-invoices are recognised as a “tax document”.

- Some buyers use 3 different ERP systems and data is scattered – TUNG is the only holder of “data” in just one place – this is powerful; TUNG will monitise this by using this data to create a supplier payment offering (fx) and by using data to improve buyers sales tax positioning

- They have got better at understanding what customers want

- Identify partners with strengths that complement their own (people who have distinctive product expertise in areas that matter to our customers and where they do things that TUNG can’t do effectively)

- Structure transactions in a way that minimises cost and execution risk

- Disciplined and effective approach to execution (bring these transactions on time and on budget)

- These efforts will make a measureable contribution to revenues FY17

David Williams

- Focus on making the business profitable/cash generative

- EBITDA breakeven by H2-2017 (30th April 2017)

- Positive EBITDA H1-2018 (31 Oct 2017)

- If revenue growth slower than expected, actions will be taken to reduce costs

- Decouple revenue growth and growth in the cost base

- Reduce on-going cash requirements

- Complete sale of Tungsten Bank

- Manage working capital more effectively

- Invest in necessary technology to drive operational leverage

- Indeed Tungsten is a company in transition

- When you contrast new measures put in place, we can see that the transitions put the company in a place to grow the company very meaningfully

- Company is now multi-product line (Workflow, Purchase Order, E-invoicing, Analytics, Early Payment, Adjacent Services)

- Whilst historically focused on buyer relationships, renewed focus on suppliers as a means of growing revenues in ways we had never considered before

- Strategically working up the value chain delivering good advice to Global Process Owners, Chief Procurement Officers, CFO’s and Treasurers – they want to hear from Tungsten

- What we should hear is that we were a company that sought to grow fast and didn’t put in the management principals and routines that we needed to ensure that was controlled and more thoughtful – today we are.

Rick wants us to take away three things from today’s proceedings:

1. We have remedied past ill’s: we’ve understood them, analysed them, considered them and made choices with respect to them and moving in new directions

2. Those directions have provided a clarity of purpose within our organisation that gives us a framework within which to work that’s shared around this organisation; we know where we have turned our guns.

3. There is a group of leaders that have track record and that can ensure that we reach that summit as we saw in the video

My closing remarks:

There was an atmosphere of candour that we haven’t seen before. A lot of thought and consideration has clearly gone into how Tungsten wanted to conduct themselves with shareholders given past expectations and execution performance. The level of transparency we are being shown is refreshing though perhaps a lot to be alarmed about from ‘past ills’. The fact they’ve identified the problems and rectified most of them or in the process of tackling some of the others gives me a lot of confidence. This is a great company, I believe management team are world class and the employees are supportive of the new management team. With renewed clarity and purpose, going forward I very much get the sense they now are fully aware of what they strategically want to achieve and they have the tools, people and partners to do it. All the speakers for TUNG appeared decisive and focused, this will no doubt channel all the way down on a company level. They have clear road maps, strategy, framework and accountability in place and in my opinion they’ll be able to massively deliver on that. The TEP opportunity is still as strong as ever.

I spoke to a couple of TUNG employees during refreshments. They have commented that under new management they feel a transformation in the leadership and focus, they feel like that have much more direction and support and they also love the new CMO who has only just recently started. I got the sense they are excited about working for TUNG and being part of the resurgence.

Did anyone else note this? During the opening statement Rick alluded that Iain Hunter has a significant piece of his future revenues coming from financing receivables – so I take from that that after the bank is sold, the new owners will do business with TUNG and finance receivables as a new funding partner? (16:20)